RPA - a Life or L&P Insurance Company “Closed Book” Lifeline

Share at:

Global insurance markets are quite different from one another – a reflection of business culture and also regulation by their respective political bodies. Global insurance products, on the other hand, have many common characteristics because they meet universal needs. For example, the vast majority of insurance markets have products for home, business, car and life; all similar, but with variations. In the U.S., a dominant long term product is life insurance, whereas in the U.K. its counterpart is life & pension insurance. Both of these long term products share another common characteristic – they can consist of open book or closed book policies.

A life or L&P closed book product is a premium generating policy that exists between the company and the policyholder, but is no longer for sale. Why would that happen? The product might be unprofitable, the company might be rationalizing its product portfolio or it might not fit existing sales and marketing strategies. Once closed, the product is in “run off” mode because revenues can only decrease going forward.

The Closed Book Legacy Conundrum

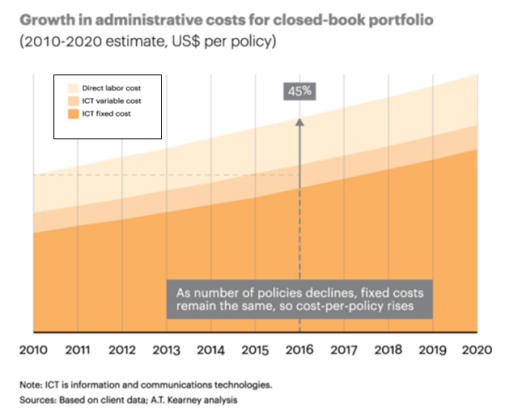

It was mentioned earlier that the insurance industry is highly regulated, and so it is. In the case of closed book products, this means the company must continue to administer the product – even if only one policyholder remains. This immediately places the closed book product in a profitability spiral because, as the number of premium-payers slides, the policy administration costs per policy can only increase.

Unfortunately, this closed book profitability spiral is playing out against a global insurance industry backdrop far different from what existed prior to the 2007 financial crises. Since that historical moment, the global insurance industry has faced three challenges which make profitability as a whole an increasingly serious issue.

Slow Growth & Increased Competition: in 2014 life insurance products snapped a multi-year period of declining sales volume but continue to face stiff competition from investment products crowding into the life insurance space.

Compliance & Regulatory Complexities: both in the U.S. and the U.K. increasing levels of compliance and regulatory requirements are driving up policy administration and operational costs.

Low Investment Returns: global insurance industry revenues from investment portfolios remain low by historical standards, putting pressure on policy management costs.

Profitability is a serious issue for the global insurance industry, not just for its own sake, but because a large number of insurance companies have delayed technology and operational investments for budgetary reasons.

Open book policy operations benefit from modern systems capable of supporting product lines with flexibility, customization and efficient regulatory enhancements. Instead, most insurance companies are working with a patchwork quilt of legacy systems – either grown through the years, the result of numerous acquisitions, or both. Compounding the situation is hard-to-find skill sets and diminishing tribal knowledge of systems and processes, held by a dwindling number of older employees. All of these attributes add to the risk of re-engineering the system or migrating data to a new one.

The legacy situation for closed book policies is the same or worse because there are typically multiple systems tied to various closed books, creating redundancies and overlapping IT staff, many of whom have unique skills and knowledge. Staff constraints are equally severe on the business side, where specialized knowledge is required to operate the system and implement changes.

Escaping the Legacy Conundrum

Addressing the legacy problem for open book policies is challenging, but certainly possible, because insurance system modernization projects are difficult but not exceptional. There are numerous precedents.

The peculiar economics of closed book policies preclude a modernization solution – the profitability spiral makes an ROI for that investment impossible; not to mention a new system would be sunset as soon as the last policyholder is gone. That leaves three alternatives:

IT outsourcing: let an outsourcing service provider take care of the mess for less. This option has transition and operational risks for the same reason the legacy systems and business processes are problematic for the company. In addition, there are contract risks of getting locked into the vendor and policy administration risks since the company remains responsible for regulatory compliance.

Migration: migration from one legacy system to another (closed book – open book) is problematic because integration is difficult and manual steps don’t scale. Another choice would be migrating when a new system is implemented for the company’s open book policies. Consolidating policy management would increase the business case for a new system, but would take time to see the benefits and the claims migrations would still carry risks.

Business Process Re-engineering: this option would address inefficiencies, business knowledge and skill sets issues on the operational side but leave the intractable legacy system issues untouched. Optimizing processes would cut costs and also make outsourcing a less risky proposition, since only the legacy systems would remain unimproved and loosely documented.

Sell the closed book policies: getting cash for policies in a poor profitability position is an attractive proposition. In fact, buying and selling closed book policies is a common occurrence in the insurance industry. There are two potential disadvantages: one - any buyer would put risk contingencies, migration costs and profit/loss projections into the price (so it could be very low); two – potential cross-selling revenue from those policyholders would be lost forever.

A close look at these options makes several things clear. Selling the closed book policies and swapping cash for a profitability spiral is the most attractive alternative. However, since two downsides – strategic reservations by management and very low price – are unknowns, it can’t be assumed this choice is possible.

IT outsourcing is the fastest way to achieve savings because labor arbitrage is an almost immediate benefit. However, the outsourcing provider will find themselves caught between two opposing considerations: on one hand, acquiring process knowledge and transitioning could be expensive and require a lengthy contact to amortize; on the other hand, a steadily rising cost per claim makes a long term contract more risky as time goes on.

Migration also carries risk and is less practical since it can’t begin until a new system is ready to accept the data.

Process re-engineering is likely to reduce operating costs but the ROI for those types of projects is notoriously difficult to determine.

The Robotic Process Automation Lifeline

The continuous innovation of Robotic process automation (RPA) has placed the technology in a position to offer a different perspective on these alternatives.

Just two years ago RPA was viewed as a swivel chair, single point, desktop automation product that could offer significant benefits to just one of the options: migration. Published use cases continue to document how robots can move several hundred thousand policies (or more) from a variety of legacy systems to a target system much faster than a manual approach.

Today the UiPath RPA product is no longer tethered to the desktop. Instead, it is a platform capable of pooling large numbers of robots in a single location, queuing work and orchestrating their activities from a management console. Just as desktop automation made manual tasks obsolete, so an automation platform makes desktop robots obsolete.

In the case of the closed book legacy conundrum, the interface precision, process speed and data extraction accuracy is such that migrating policy data into the open book claims systems is a viable option. Of course, it’s a case of migrating from one legacy environment to another, but IT costs would drop as redundancies in IT staff were eliminated and the open book support staff would be effectively optimized across both policy books.

Further, robotic process automation can also be implemented as part of the business process re-engineering option to significantly reduce operational costs. Again, because the UiPath product has moved beyond the limitations of single point, desktop, automation, people can be replaced within the re-engineered processes on an end-to-end enterprise level – with robots orchestrated from the management console.

In addition to tackling IT and operational closed book policy costs, a robotic automation platform will conform to life insurance and L&P insurance compliance requirements. Whether migrating hundreds of thousands of policies or automating dozens of processes and sub-processes, the UiPath product generates complete log files for each robot action and stores those files in a secure, centralized, data repository.

This elevation of choices for the closed book legacy landscape typifies the innovation and power of the RPA technology. It doesn’t take a disruptive and exclusionary role in problem-solving; instead it uses a very modest integration footprint to introduce efficiencies and performance far beyond what was possible just a few short years ago.

Strategic Advisor, Tquila Automation

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.