Client:Ladbrokes Coral

Region:Europe

Industry:Media and Entertainment

Transforming Customer Compliance Operations

88%

faster than manual processing

322

applications processed

48

man hours saved

100%

accuracy delivered

520 hours

of effort freed yearly

Client Overview

Ladbrokes Coral is one the UK’s largest betting and gambling companies with an annual revenue in excess of £1.5 billion. Ladbrokes Coral was formed from a merger of Ladbrokes and the Gala Coral Group, and has recently been acquired by GVC Group Holdings.

Implementing a new technology isn’t always easy. Ladbrokes Coral understood the benefits of robotic process automation (RPA), but an early program didn't meet its objectives.

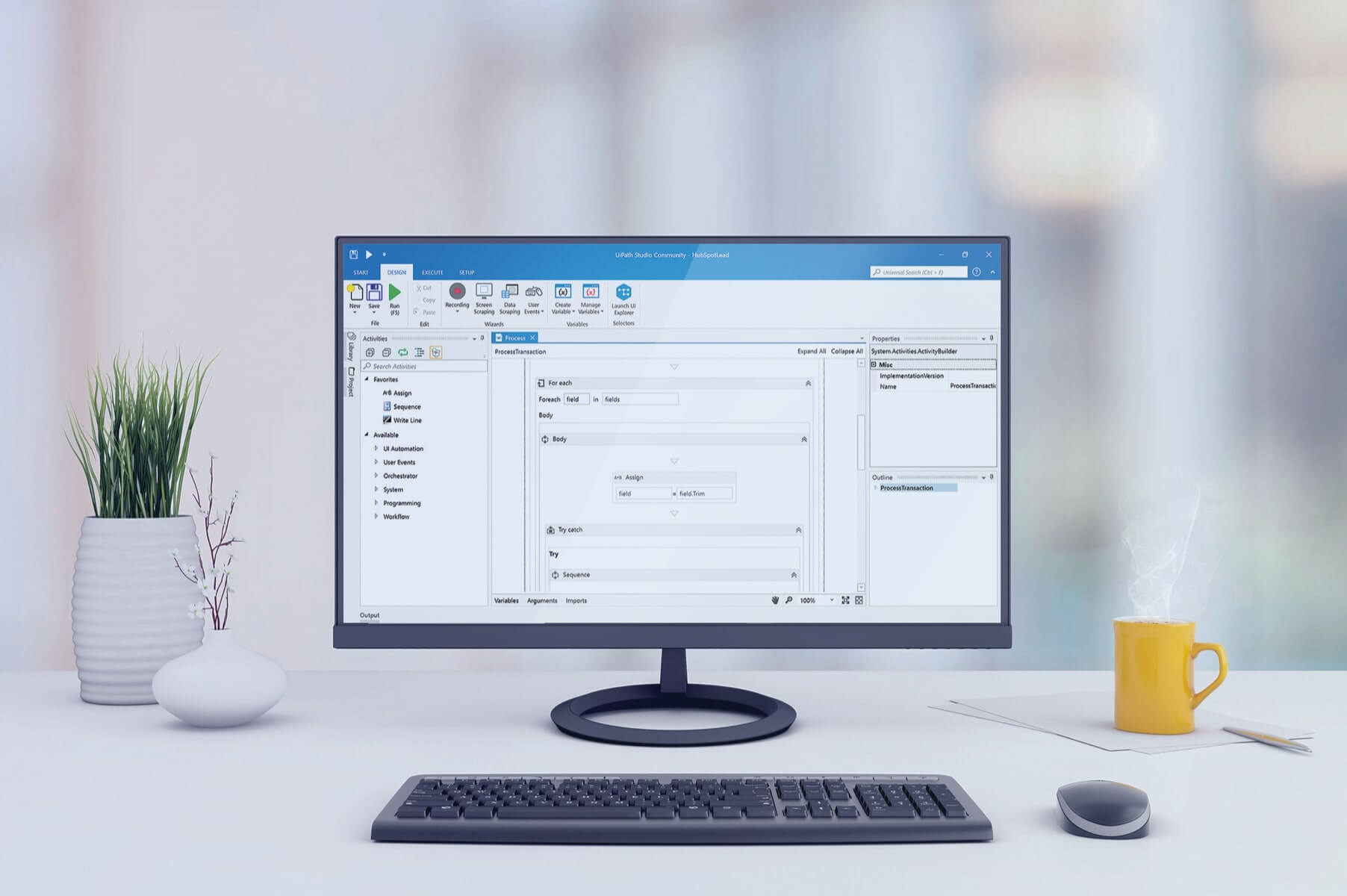

When the company learned about UiPath, it was convinced to try again. The result has been a transformation of Ladbrokes Coral’s key processes within its customer compliance operations department, and the improvement of its customer experience.

Ladbrokes Coral is one of the UK’s largest betting and gambling companies, with an annual revenue of more than £1.5 billion. Ladbrokes Coral was formed from a merger of Ladbrokes and the Gala Coral Group, and has recently been acquired by GVC Group Holdings. Their customers are very loyal and, as research has shown, customers use the service every day. In large part, this is because of the high level of customer experience the company delivers.

The companies merged in 2016, and the new organization focused on harmonizing its operational processes and continually improving the customer experience while guaranteeing compliance with growing regulatory directives from the UK’s Gambling Commission. Customer compliance operations have played a key role, and a new shared service center was launched in Manila in the Philippines. This proved to be a key step highlighting the opportunity with, and benefits of RPA.

In the first day of live operations, the Robots were saving 51 hours each day or the equivalent of six people working an eight-hour shift.

Brendan MacDonald • Director of Customer Compliance Operations

MacDonald explains: “With the large team in Manila, we were able to produce high-quality work cost-effectively, and increase productivity. It was clear that the best results come when the business function is process-driven. However, our processes were still quite manual, and repetitive tasks consumed a good deal of the team’s working day. We believed that RPA could improve our processes and we could also claw back valuable time for our shared service team.”

Learning from your mistakes

Ladbrokes Coral’s first attempt to introduce RPA to automate two processes was not successful. The early automations weren’t robust enough, resulting in the work having to be manually repeated. The operations team quickly lost faith in the technology, and the robots were decommissioned. Although the program hadn’t delivered the expected benefits, it was enough to show the promise of RPA. The company just needed the correct RPA solution.

Ladbrokes Coral discovered UiPath, and Jim Noakes, Head of Strategic Development and Optimization for customer compliance operations, attended the UiPath FORWARD conference. MacDonald and Noakes were convinced that the UiPath Enterprise RPA platform offered both the robustness they needed and the ease-of-use that had been lacking from their earlier program. More importantly, not only would UiPath RPA meet the company’s operational and technical requirements, UiPath was also financially attractive—specifically regarding return on investment (ROI).

“After our initial experience with robotics, ROI became a leading indicator and primary reason for selecting UiPath,” says MacDonald. “Its licensing model allows for a more scalable approach, making it more attractive and affordable for proof of concept (PoC) work and running pilots.”

Four small processes were initially selected for the UiPath RPA pilot automation, including e-wallet balance reporting. This process reconciles the balances from over 32 separate payment platforms into the company’s e-wallet. In the past, this seven-stage process took over two hours for a staff member to complete. Within eight weeks, the pilot had delivered a robot that could complete the process in just 13 minutes. With RPA from UiPath, the process was 100% accurate, 88% faster, and freed over 520 hours of effort each year.

“All the pilot automations were completed on time, within budget, and provided ROI. Part of the pilot projects was to help make recommendations for a suitable robotic operating model and build a pipeline for future automations. The results gave us confidence, and we selected two priority processes that were more complex but were expected to deliver far greater benefits and returns,” says MacDonald.

On the recommendation of UiPath, Ladbrokes Coral selected Lawrence & Wedlock, specialists in RPA automation and process transformation, as their strategic partner. The company worked with Ladbrokes Coral on the pilot automation. After the successful result, they were put in charge of delivering the next stage–managing everything from IT infrastructure through design, build, deployment, and management of the robotic process automations. The key priority process that Lawrence & Wedlock worked on was the know your customer (KYC) verification updates process.

After our initial experience with robotics, ROI became a leading indicator and primary reason for selecting UiPath. Its licensing model allows for a more scalable approach, making it more attractive and affordable for proof-of-concept work and running pilots.

Brendan MacDonald • Director of Customer Compliance Operations

KYC: the key to a responsible gambling business

To protect both the customer and the industry, KYC is very important for the financial services and gambling sectors. It involves properly verifying the identity of customers to minimize the risk of fraudulent or illegal trading activities. It also requires that a company undertake a series of checks—such as proof of age, proof of address, and anti-money laundering—to ensure a person is who they say they are.

To follow KYC regulations, Ladbrokes Coral continuously runs its customer verification process from its Manila shared service center. The customer verification process establishes new accounts as quickly as possible. First, the new customer submits supporting documentation, such as a driver’s license or passport. The process then either accepts the identification information or passes the account application to a staff member to follow up, ask for more information, and then accept or reject the application.

Although there are only seven steps in the process, there is a wide variety of variables and outcomes for each step that can add significant time and effort to the process. The manual process required up to eight working staff members. Lawrence & Wedlock and Ladbrokes Coral collaborated to create unattended Robots that automate much of this process. Lawrence & Wedlock designed and built the automated solution, including setting up the routines for managing all of the process variables and exceptions. The automated system provides comprehensive reporting on process outcomes and robot performance. Importantly, it is extremely scalable, so multiple robots can be quickly added or removed as work volumes dictate.

The new system quickly exceeded expectations. Once the Robots were deployed, it took just 49 seconds to complete the process, as compared to five minutes on average for a member of the shared service team to do it. Ladbrokes Coral estimates that this has returned over 5,500 hours each year and saved the company over £25,000 each year.

The robots handled over 7,000 customer verifications in the first four weeks alone. That’s an incredible volume of work in such a short time.

Brendan MacDonald • Director of Customer Compliance Operations

The performance of the Robots has impressed MacDonald. He says: “In the first day of live operations, the Robots were able to process 322 applications. That’s a gain of 51 hours each day, or the equivalent of six people working an eight-hour shift. The Robots handled over 7,000 customer verifications in the first four weeks alone. That’s an incredible volume of work in such a short time.”

It is not only the speed that has pleased MacDonald, but the complete accuracy and consistency that the Robots deliver.

“We know that we are getting 100% accuracy and it’s only on deploying this new RPA system that we are able to see how many issues we previously had to deal with. We have been able to remove all of the issues by letting the Robots take care of the repetitive tasks and freeing the team to handle exceptions,” he comments.

Robots are our friends!

Using robotic software has helped to make the Manila shared service center more productive. The staff’s time has been freed up from manual, repetitive tasks, such as saving verification documents and updating the company’s CRM and provisioning system. This time has been redeployed to higher-value and more fulfilling tasks, such as handling customer queries and exceptions, and performing quality assurance to enhance the customer experience.

Julian McDonald (no relation to Brendan), Verification Manager for Ladbrokes Coral Customer Compliance Operations team, says: “Innovative, reliable, cost-effective, and a vastly improved customer journey”

Moving forward

Software Robots deployed within the Manila operational shared service center have automated around 70% of the process, with an exception queue handling the remaining workload. The UiPath Enterprise RPA platform has enabled the company to update its processing rules and simplify the process, which the company estimates will soon mean that Robots automate 85% of the process. This will save more time and further boost productivity.

Innovative, reliable, cost-effective, and a vastly improved customer journey.

Julian McDonald • Customer Compliance Operations Manager

The success of RPA with UiPath has led Ladbrokes Coral to begin scoping future automation projects. This will begin with the automation of more customer operations processes within the shared service center and expand into its customer service team to continue to enhance the experience of its customers.

Related case studies

Ready for your own case study?

Speak to our team of knowledgeable experts and learn how you can benefit from agentic automation.