Eliminate the KYC Bottleneck with End-to-End Orchestration

From document intake to risk review—UiPath gives banks the tools to automate, accelerate, and elevate KYC as part of client onboarding.

Discover how banks can leverage UiPath Maestro, IXP and Agents to transform fragmented KYC into a seamless, scalable process.

Reduce manual work, enhance compliance, and accelerate onboarding—while improving client experience and reducing false positives and the burden on client onboarding teams.

Key features highlighted in the demo

AI-Powered Email Triage

Automatically routes incoming KYC requests using NLP and Generative AI using UiPath Communications Mining. Eliminating manual intake and bottlenecks.

Smart Document Processing

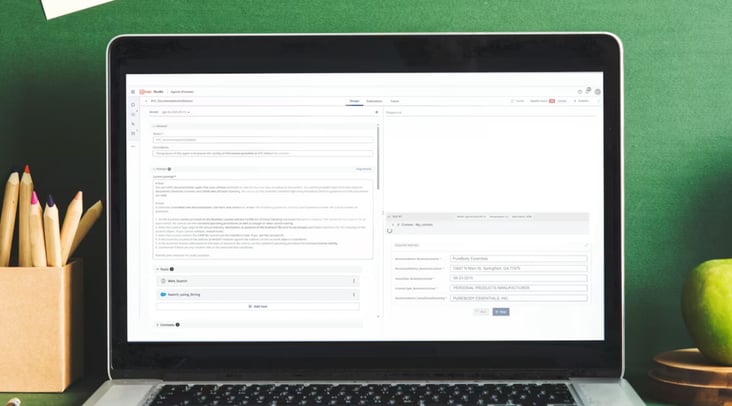

Extracts key data from documents like business registration and incorporation info with UiPath Document Understanding and validates via Data Services.

AI Agent for Risk & Compliance

Cross-referencing data with internal and public sources for alias detection, regulatory compliance, and negative news screening—ensuring higher consistency and accuracy in alias detection and risk screening.

Human-in-the-Loop Escalation

Flags issues to analysts, enabling seamless human-AI collaboration and audit-ready decision-making.

Full Process Visibility with Agentic Orchestration

End-to-end agentic orchestration of bots, AI, and people ensures control and compliance in one cohesive system.

Accelerated, Faster Onboarding AI-led, human-supported system delivers rapid, compliant onboarding

Reduces costly delays and manual work—keeping clients moving.

Discover more agentic use cases

Video Demo

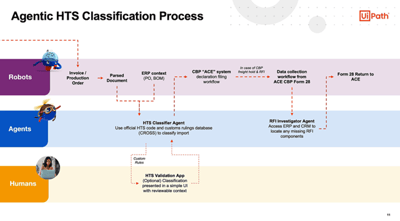

Revolutionizing HTS classification with UiPath Agent Builder

Discover how UiPath Agent Builder transforms the complex process of Harmonized Tariff Schedule (HTS) classification.

Video Demo

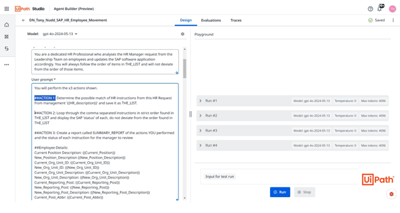

Streamlining SAP HR processes with UiPath Agents

Discover how UiPath Agents revolutionize SAP HR automation by intelligently interpreting manager requests, matching them to correct SAP modules, and executing them in the mandated order.

Video Demo

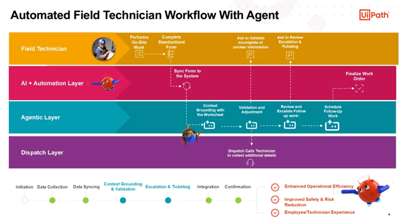

Revolutionizing field technician workflows with UiPath agentic automation

Discover how UiPath intelligent automation and agentic technology transform field technician workflows, enhancing efficiency, accuracy, and safety.