UiPath Automation Solutions Optimize Finance & Accounting Processes

Share at:

Over the past ten years, the outsourcing of finance and accounting (FAO) processes has steadily increased. The underlying rationale for the trend remains – as might be expected – an unremitting focus by senior management on efficiency and savings. In that time period, a significant catalyst for the acceleration of this outsourcing trend was the widespread implementation of ERP systems, which occasioned the standardization of financial & accounting practices and processes. Now, however, an emerging technology - robotic process automation (RPA) is also beginning to influence this outsourcing trend.

There are two compelling reasons that process optimization using robotic tools has begun to exert influence in the FAO arena.

Diminishing Offshore Arbitrage Benefits: cost pressures are unabated, yet the returns from simple offshore BPO labor arbitrage solutions are diminishing. Some of this is because many remaining finance & accounting functions aren’t easily performed remotely. Another factor, faced by all outsourcing providers, is offshore wage inflation. Increasingly, offshore providers are achieving additional cost cuts by sharply diminishing their onsite presence, a tactic that can also significantly increase delivery risks.

RPA is less expensive – and more productive - than offshoring: The Everest Group’s Finance and Accounting Outsourcing Annual Report 2014 stated that financial & accounting (FAO) robotic tools are up to 65% less expensive than offshore-based employees. Further, software robots work 24/7 without any erosion in quality or accuracy.

Caught in a squeeze between constant savings pressure and depleted value propositions from offshore providers, the Chief Financial Officer (CF0) in many companies has been forced by necessity to give a serious look at robotic process solutions as an alternative source for innovation and cost benefits. Not surprisingly, many in the finance and accounting world are wondering just how – or if – RPA technology and the traditional BPO business model will coexist.

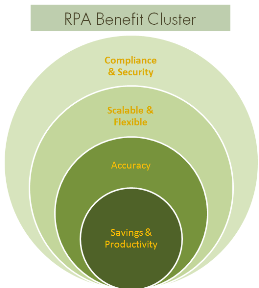

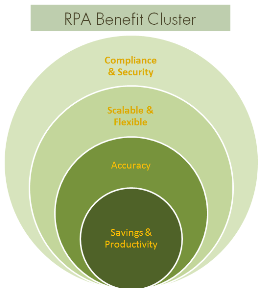

The RPA Benefit Cluster

As CFO awareness of key automation advantages over simple labor arbitrage grows, so does their expectations that offshor

e providers will match the full RPA benefit cluster. The CFO is beginning to realize that automation will do more than outstrip the cost reduction capability of labor arbitrage; it will also provide scalability for seasonal processing surges and rules-driven behavior that always adheres with compliance and security policies.

In the Finance and Accounting Outsourcing (FAO) industry, Robotics Process Automation is fast emerging as a innovative technology solution capable of delivering multiple benefits—cost savings, enhanced accuracy, scalability and increased compliance. FAO providers are increasingly leveraging it to better execute transaction volumes by using this new technology on repetitive processes - in most cases decreasing rather than maintaining FTE headcounts. This new dynamic - headcount reductions, even in the face of higher transaction volumes - can allow the CFO to realign resources and give a greater focus on strategic, high-value customer facing roles.

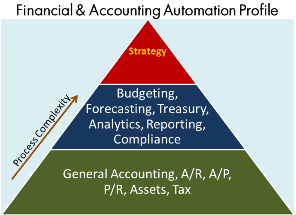

Key Finance & Accounting Process Areas for Robotic Process Software

There are three key Finance & Accounting process areas for optimization benefits:

Within these groups, there is a progression of process complexity, beginning with general accounting and reconciliations and escalating to reporting, compliance, analytics & forecasting – all of which are typically linked to several systems and pull data from multiple sources.

UiPath solutions are designed to deploy quickly and move smoothly up the process complexity scale. They work with all major desktop, Web, ERP (e.g. SAP) suites and Citrix (virtual desktops) applications, making it easy to address all client supplied business like sales and work orders, billing and invoicing, credit requests or claims processing.

UiPath’s software products not only enable businesses to reap substantial benefits from process optimization, they extend those benefits to advanced operational and process analytics. Further, UiPath robotic solutions accomplish this with rapid time-to-market and very reasonable price points—a combination that simply wasn’t available just a few short years ago.

These capabilities are possible because the UiPath platform seamlessly leverages the customer’s current state UI and enterprise applications, regardless of whether those applications are in-network, virtual (e.g. Citrix) or in-cloud. There’s no impact on security, compliance or governance because UiPath’s software robots operate within all existing security controls and access restrictions, their deployment doesn’t involve either back-end integration or API client data access.

The flexibility and scalability of UiPath software products are grounded in the fact that they are technology-agnostic – allowing them to be deployed for the optimizing of any data-driven, rule-based processes., It means UiPath software robots can be deployed across all Finance and Accounting core processes, whether it be Order-to-Cash, Record-to-Report or Procure-to-Pay, increasing its cost effectiveness value proposition to an even more compelling level.

Strategic Advisor, Tquila Automation

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.