Transforming loan origination with agentic automation

The loan origination process highlights the challenges of traditional methods and the benefits of agentic automation

This demo emphasizes how agents and automation can streamline document processing, enhance compliance checks, and improve risk assessment accuracy.

Key features highlighted in the demo:

Agentic automation integrates UiPath IXP (Intelligent Xtraction & Processing) to efficiently read and process loan application documents, eliminating manual bottlenecks.

Agents conduct intelligent investigations of policies and system data, enhancing decision-making consistency and reducing compliance risks.

Robots perform complex risk calculations (DTI, LTV, affordability) with higher accuracy, reducing the error rate associated with manual processes.

Discover more agentic use cases

Video Demo

Agentic work order processing for mining and natural resources

Discover how agentic automation is revolutionizing work order processing in the mining and natural resources industry by streamlining the entire workflow.

Video Demo

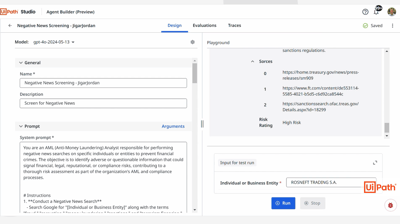

Risk and compliance: Negative news screening

This demo showcases an agentic automation designed for anti-money laundering (AML) purposes.

Video Demo

Supply chain: Order management agent

This demo showcases an AI agent embedded in an order management workflow.