Getting Started With AI In Insurance: An Introductory Guide

Share at:

There’s a gap between awareness of artificial intelligence (AI) and application.

According to McKinsey research, only about 20% of companies that are aware of AI are using AI at scale or in a core business process. And according to a 2019 MIT Sloan Management Review study, a mere 7% of surveyed organizations have applied machine learning (ML) and AI in decision making or production workflows.

Insurance companies, most just starting their AI journeys, are likely to fall into this awareness and application gap. Though insurance companies have used data-intensive workflows for decades, many still aren’t using AI to its fullest—or at all.

Earlier this year, we hosted a panel of experts to discuss AI in Insurance as part of our AI Summit. During the session, guest experts from Forrester Research, Cognizant, and Mercer shared insights and experiences from their work in the insurance industry.

This article will break down the session into a few key ideas, but for the full experience, head on over to the AI in Insurance session page.

Here, we’ll focus on trends in AI and a three-step process insurance companies can use to get started with AI.

AI insurance trends reveal it’s time to invest now

Throughout the “AI in Insurance” session, it became clear that the future of the insurance industry will revolve around increasing organizational agility by putting AI front and center. Digital transformation is becoming imperative to achieving market leadership and facilitating an innovation-focused culture. AI is becoming an essential part of that transformation.

2020 changed the insurance industry

2020, a strenuous year for all industries, was a pivotal one for the insurance industry.

2020 forced the insurance industry to reckon with its ability to meet the rapidly evolving needs of customers, partners, and employees. McKinsey, for instance, pointed out in a 2020 report that “Insurers that have developed mature digital functions in sales and distribution, service and retention, and claims are well-positioned to weather the crisis—and those that haven’t must act fast to catch up.”

This reckoning revealed that digital transformation was not only necessary to survive the crisis, but necessary to thrive moving forward.

From 2021 on, AI and automation—centerpieces to enterprise digital transformation—are going to be high priorities for forward-thinking insurance companies.

The future of insurance

The future of insurance is going to be open, connected, and automated.

Guest panelist Ellen Carney, Principal Analyst, Forrester Research

In contrast to other industries where technology budgets tend to be decreasing, insurance technology budgets are increasing, explained Carney on the panel. According to Carney, citing Forrester research findings, a 1.4% increase in insurance company technology budgets will accelerate the future of work and the future of the customer experience.

It's important to note that much of this budget increase isn’t just going to maintenance. Carney shared that 33% of this budget is going to new projects.

Holly Olive (Digital Operations, Insurance Consulting Lead at Cognizant at time of the panel) agreed and warned that as budgets shift, momentum will increase, and laggard companies might be left behind: “The train is moving, and you want to be on it.”

The future of AI

The future of insurance, however, will depend not just on companies’ willingness to adopt AI but their ability to pursue, adopt, and implement business solutions that leverage AI.

Skepticism around AI occurs because in many industries, technology hasn’t kept up with the promises of its marketing. AI and ML have become marketing buzzwords in many circles. Companies with products that offer simple, rules-based automation are often willing to claim their products are intelligent when they aren’t. Those products can still be useful, but they aren’t delivering the impact that true AI-based solutions can provide.

Where hype meets reality, according to keynote speaker Craig Le Clair, Principal Analyst at Forrester, is in platforms that enable focused horizontal and vertical use cases. Le Clair explained during the AI Summit keynote that while AI used to be a separate tool, it will now become part of almost all technologies: “AI will seep into applications and become a normal way of doing business.”

The future of AI won’t be adopting a fancy tool and letting it lead you in the right direction; it will be developing a smart business strategy that leverages the advantages of AI.

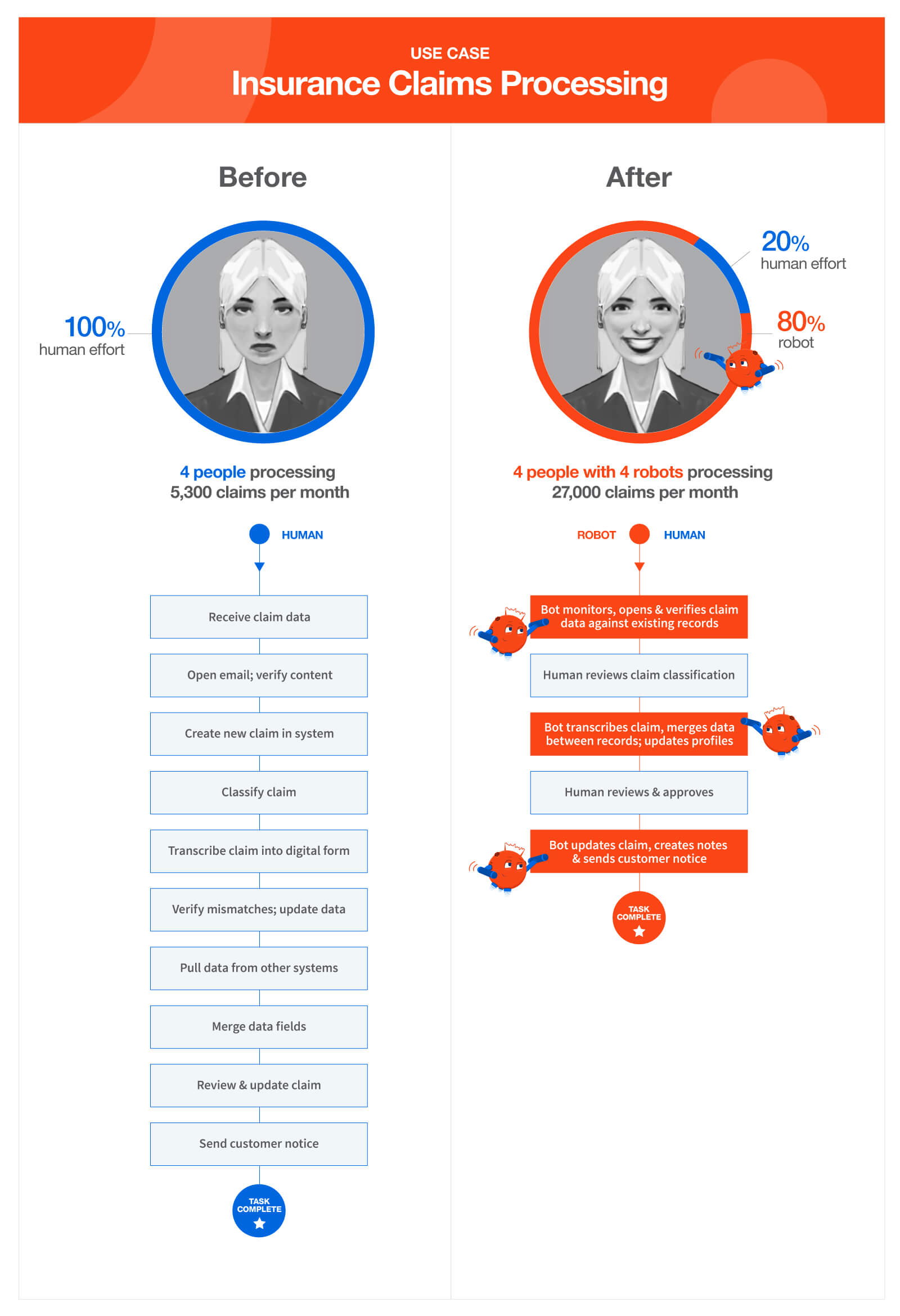

AI insurance example: claims processing

Use cases for implementing AI into insurance processes abound, but there’s one process that’s particularly ripe for AI: claims processing.

There are four aspects of claims processing that make it a great candidate for AI:

It’s time-consuming.

It may be prone to errors.

It doesn’t scale.

It requires subject matter experts.

A traditional insurance claims process goes like this:

Claim documents enter your system from a customer, intermediary, or third party.

A subject matter expert manually reviews the documents for required data, (a cognition-heavy process that requires their specialized expertise).

An employee manually keys data into a claims system.

A subject matter expert assesses the claim against the policy.

An employee runs a sample fraud check to manually check against known risks.

A human approves or rejects a settlement.

In a claims process with AI, it looks more like this:

Claim documents enter your system from a customer, intermediary, or third party.

A software robot uses AI to automatically extract data from the claims documents.

A product like UiPath Document Understanding uses ML models to extract structured, unstructured, and pictograms from documents.

Software robots enter the data into your claims systems.

An employee quickly reviews data, if required, for validation.

Notice how, in the second example, a human only enters the process in the last step and even then, only as necessary. The claims process is faster, less prone to errors, and involves much less manual, human effort.

Now, employees can re-focus on more engaging, human-oriented activities, leaving software robots to handle the repetitive tasks.

With AI embedded within an enterprises’ technology solutions portfolio, employees can refocus from tedious, repetitive tasks like claims processing to more engaging, cognitively challenging tasks.

Get started with AI using these 3 steps

Our panel shared three core steps for getting started with AI. Each step will make AI easier to implement and more effective.

1. Start small

Find practical use cases and pick a pain point to prioritize them. Ensure that whatever use case you pick is small enough to be practical but painful enough that the solution is measurable and impactful for stakeholders.

According to one of our panelists, Kieran Gilmurray, Global Automation and Digital Transformation Expert at Mercer, one advantage of the insurance industry is that use cases are plentiful, proven, and validated. Use cases are already well known, so this isn’t a place where you need to innovate.

Olive recommended starting with AI for email classification. Carney agreed: with 20 million emails received a year, and upwards of five minutes spent on each one, email automation presents a big-impact, low-risk opportunity.

The challenge is that customers are regularly emailing customer support with a huge range of questions that can accumulate into long response times. The opportunity is that with AI, you can shorten those response times and become increasingly efficient where other companies are still slow. For early adopters of AI, this advantage can compound, enabling you to outpace competitors and get so far ahead that they can’t catch up.

With AI-assisted email, you can understand incoming communication and predict the following communications. Which means that customers don’t even need to ask certain questions—you’ve already answered them.

Olive says that by starting smaller, you can attack the value chain a little bit at a time.

2. Align to ROI

Any transformative technology requires investment, but the investment required isn’t always a capital one. Capital is important, but more important is the investment in a culture of innovation. You have to encourage a culture that looks past existing methodologies and practices so that they can adopt a technology as game changing as AI.

Both kinds of investment require you to think carefully about ROI. To align your ROI vision with reality, you’ll want to frame your ROI analysis with process discovery.

Many in the insurance industry have become accustomed to the number of decision points existing processes contain, which makes them forget just how complex many processes have become.

The potential for AI to handle some of these complex processes is immense, but only if you document and review your businesses first––with data, not anecdotes. The goal of this discovery is to determine where you can provide the most value via AI.

UiPath Task Mining and UiPath Process Mining can both help you understand your processes and their bottlenecks. With these process discovery tools, you can prioritize AI use cases based on measurable business outcomes.

From there, you can begin to broaden your understanding of ROI.

Gilmurray warned that though there are near-term AI use cases, wider transformation will require more than the flip of a switch. Implementing AI involves a path of improvements that eventually lead to significant changes in business operations.

Don’t pressure the team to deliver immediate returns, but do understand the direction of the project and where returns will come from. AI is similar to, in a sense, a new employee, meaning it takes time to train it and get it ready for production. And similar to an employee, AI-based solutions can learn and adjust based on the demands of the business.

Olive warned that many companies will overfocus on cost reduction as their primary metric.

The true value of AI, however, isn’t just in what costs it eliminates but what value it produces. AI will, for instance, create better turnaround times and higher customer satisfaction, meaning better customer loyalty.

If you can accurately estimate ROI, from its most narrow returns to its greatest potential value, then you pick the efforts with the most potential every time. You can use a product like UiPath Automation Hub to create a central location for automation ideas that you can then organize and prioritize.

3. Scale by putting business strategy first

For digital transformation to deliver against your enterprise-wide strategic goals, AI adoption can not be siloed within a single team. With the support of both a capital investment as well as a cultural investment, your organization can embrace and extend adoption. If you can’t get widespread adoption, then digital transformation won’t happen, and you risk your AI project stalling as a prototype.

Only a prioritization of business strategy will ensure AI scales and spreads.

The risk is that companies put technology ahead of business strategy. If you focus too much on the technology, Gilmurray warned, then you’ve got the equation wrong. It’s business strategy first.

Gilmurray recommended that you understand the business-level (or at least department-level) strategy to know what you’re contributing to. Technology enables business—it’s people, process and then technology.

You should be asking two questions, he said:

Where do we want to go?

How will we get there?

Too many companies focus on the second question without addressing the first.

Insurance is already a data-driven industry, so if you can deliver the right data, at the right time, to the right people, then massive benefits will follow. The ROI calculation won’t only involve the number of hours saved (but that is often times the number-one driver). This calculation will be informed by business strategy and take into account what your competitors are doing and any weak spots in your current business, such as service-level agreements (SLAs) and customer response times.

Survive digital Darwinism with AI by your side

Gilmurry discussed how 2020 accelerated our progress into an age of “digital Darwinism.” In this age, only the strongest will survive. But strength won’t be the result of brute force—it will be the result of companies’ willingness to adapt to a changing environment.

New technologies and new complementary business strategies will pave the way for insurance companies to become fully automated enterprises. A fully automated enterprise™ is one that fully embraces automation, AI, ML, and the digital transformation benefits those technologies unlock.

A fully automated enterprise is one that can survive change now and in the future. AI isn’t just one tool to add to your arsenal—it’s a facilitator for widespread digital transformation, and there are few industries with as much opportunity for transformation as insurance.

To learn more about how to adopt and implement AI, check out the recording of our AI in Insurance session (part of our AI Summit event). It’s available on demand so you can watch at your convenience.

Special thanks to Elaine Mannix for collaborating on this article and for co-hosting our "AI in Insurance" session during the AI Summit. Mannix is the Insurance Leader at UiPath.

Director, Global Insurance Practice, UiPath

Get articles from automation experts in your inbox

SubscribeGet articles from automation experts in your inbox

Sign up today and we'll email you the newest articles every week.

Thank you for subscribing!

Thank you for subscribing! Each week, we'll send the best automation blog posts straight to your inbox.