Agentic automation for insurance? We offer full coverage. No exclusions apply.

From risk assessment to claims processing, UiPath agentic automation accelerates workflows, reduces errors, and delivers seamless insurance experiences.

Claims, initiated. Policies, ingested. Underwriting, streamlined.

Agentic orchestration empowers you to refocus on client relationships, product innovation, and increasing value across the organization.

Drive transformation

70%

reduction in claims processing costs by using AI

Deloitte, 2024

Unlock value

33%

of enterprise software applications will include agentic AI by 2028

Gartner, 2025

Maximize revenue

16%

increase in revenue opportunities through enhanced customer engagement and new product offerings

Deloitte, 2024

Discover how agentic automation is reshaping the insurance industry

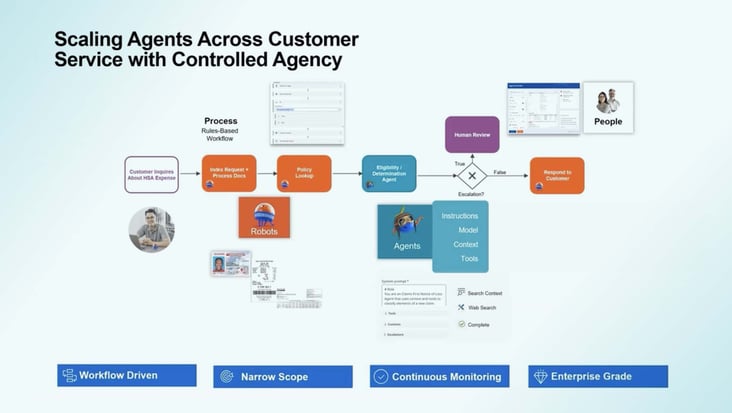

Boost HSA claim efficiency and customer experience today. Cut admin time in half, improve member experience, stay audit-ready always and work smarter, faster workflows with UiPath Agentic tools.

Comprehensive automation coverage

In a world of point solutions, the UiPath Platform™ does it all

Efficiency

Cut operational friction with end-to-end automation throughout the enterprise.

Risk

Strengthen your risk posture with data insights and near-elimination of error.

Growth

Use new data to improve product offerings and launch initiatives with fewer resources.

Innovation

Turn unstructured data into powerful insights and personalized client experiences.

See how it all comes together within the UiPath Platform

Property and casualty use cases

Transform your workflows from liabilities to assets.

- Claims management

- Customer service

- Billing and payments

- Underwriting

Stop leakage with timely insights on risk

Transform the claims experience with proactive risk mitigation advice for you and your customers. Achieve 30% potential savings through better CX, operational efficiency, and fraud detection.

Business use cases:

First Notification of Loss (FNOL) intake of claims - triage

Collation of data for Claims assessment

Claims tracking and updates on status to all stakeholders

Empower agents with the right information at the right time

Seamlessly deliver superior and faster post-sale services including policy documentation, queries, and changes. RPA and automation handle the boring stuff so agents can refocus on customer needs.

Business use cases:

Query/call intake from omni channel

Issuance of policy documents

End to end automation of Mid Term Adjustments, including cancellations, updates to contact or bank details, and more

Elevate your renewal rates with better billing

Reduce manual touchpoints by automating payments and reconciliation. ML models continuously improve exception handling with human in the loop training.

Business use cases:

Premium collections and settlement (statement issuance)

Periodic payments and premium adjustments

Claims settlement (re-use KYC process)

Underwriters agree: Ignoring automation is a risky policy

Looking for a sure bet? 40% of underwriting is administrative. Give underwriters their time back with intelligent collation of data from disconnected sources, and process that data with ML decision capabilities aided by a human in the loop.

Business use cases:

Renewals (80% of insurers business)

New Business (collation of data)

Performance reporting and peer reviews

More to explore in insurance automation

Agentic AI Summit testing breakout

Join UiPath and State Street as we dive into agentic testing—the next evolution in software testing—with UiPath Test Cloud.