Uplevel your finance and accounting department with agentic automation

By combining people who lead, agents that think, and robots that do, finance and accounting becomes more productive, spurs business growth, uncovers investment opportunities, and minimizes risk.

AI and automation do more than make finance and accounting processes more efficient. They give you the freedom and insight to make the entire business more innovative and resilient.

Discover how agentic automation in finance and accounting reduces administrative workloads and enhances both accuracy and your team’s capacity to focus on high-value, strategic work.

42%

of CFOs are moving forward with implementing AI software into their business

Deloitte, 2023

40%

faster completion of processes like financial reporting, balance sheet creation, and financial close with agentic automation

Karbon, 2025

36%

of finance functions say they’re using AI for accounts payable and receivable

PwC, 2024

Transform processes that cross organizational boundaries

Eliminate the “not-my-department” mindset with end-to-end automations that drive efficiency across the enterprise.

RELATED PROCESSES

Procure to pay

Improve days payable outstanding (DPO) by accelerating invoice processing and supplier onboarding.

RELATED PROCESSES

Order to cash

Cut days sales outstanding (DSO) by digitizing data input, automating order entry and billing, and removing errors.

RELATED PROCESSES

Invoice automation

Improve invoice processing accuracy by combining AI agents, robots, and people.

Agentic automation: see it at work in finance and accounting

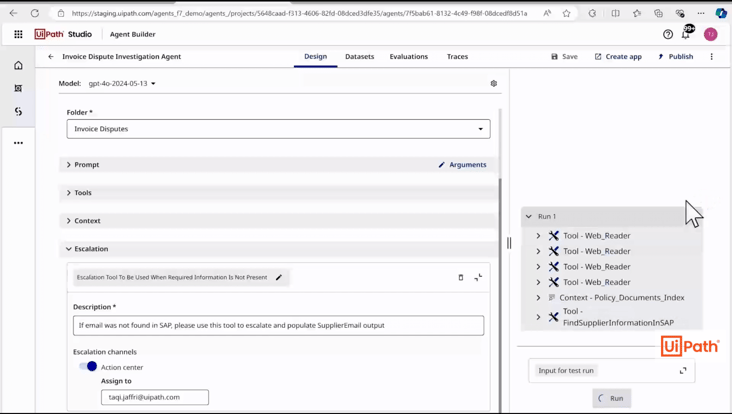

UiPath Agent Builder

Take the pain out of invoice disputes with UiPath Agent Builder

This demo showcases the power of enterprise AI agents, combining natural language instructions, diverse tools, and human-in-the-loop capabilities to create intelligent, reliable, and customizable solutions for business-critical processes.

Automate your finance and accounting department end–to end

Seamless integration

Our open architecture allows for easy integration with existing finance and accounting systems, ERPs, and other business applications.

End-to-end automation

Seamlessly integrate automation, AI, and machine learning capabilities to create comprehensive automation solutions that handle complex financial tasks from start to finish.

Intelligent process orchestration

Coordinate and optimize complex financial workflows across systems for enhanced efficiency.

Discover how UiPath helps finance and accounting teams get administrative workloads back in balance—so they can close the books on playing catch up.

Record to report: faster close, smarter finance

Streamline reporting, eliminate manual tasks, and gain real-time insight across your financial processes—focus on driving performance, not processing numbers.

- Planning and management accounting

- General accounting and reporting

- Fixed asset project accounting

- Payroll accounting

Planning and management accounting

Free your finance team from fragmented tools and time-consuming tasks. Agentic automation orchestrates planning activities end-to-end—integrating data from multiple sources and adapting to new information, so teams can focus on delivering real-time insights for better decisions.

Use cases:

Planning, budgeting, forecasting

Cost accounting and control

Spend and variance analysis

Financial performance management

Scenario modeling and trend-based reforecasting

General accounting and reporting

Move beyond manual reporting and reactive processes. Agentic automation streamlines financial operations, coordinating tasks, resolving issues in real-time, and ensuring policy adherence. Digital assistants manage the close, providing visibility, controls, and time for analysis.

Use cases:

General ledger accounting

Intercompany/subledger reconciliation

Financial close and reporting

Accounting policy governance

Compliance monitoring, audit readiness

Fixed asset project accounting

From project intake to retirement, automation ensures no detail is missed. Processes run smoothly across teams and systems, with alerts surfacing when action is needed. Finance gains clear visibility into investments, ensuring accurate and timely asset accounting—without the chase.

Use cases:

Capital planning and project approval

Capital project accounting and cost tracking

Asset capitalization and depreciation

Asset transfers, audits, disposals

Payroll accounting

Automate the entire payroll accounting lifecycle—from time capture to general ledger posting. Ensure accuracy, timeliness, and compliance with autonomous workflows, coordinating steps and resolving exceptions. Streamline payroll accounting, letting your team focus on strategic workforce and cost insights.

Use cases:

Time reporting and validation

Payroll cost allocation and accruals

Journal entry creation and GL posting

Payroll-related compliance reporting

Prebuilt automations let you reinvent the business, not the wheel

Our prebuilt automation and ready-to-go connectors can give you a head start on a more innovative future for finance and accounting.

2-way match accelerator

Drive instant ROI with industry-leading straight-through processing

Get the accelerator3-way match accelerator

Ensure payments to vendors or suppliers are accurate and complete

Get the acceleratorProcess Goods Receipt accelerator

Increase data accuracy across various incoming supplier packing slips

Get the acceleratorFinance accelerators

Speed up your automation journey with prebuilt, reusable building blocks for finance

See all acceleratorsTreasury: Optimize liquidities and cash-forecast reliability

Identify investment opportunities with greater speed and confidence, decrease uninvested cash by improving cash-forecast reliability, and digitize reconciliation processes.

- Treasury processes and procedures

- Cash

- In-house bank accounts

- Debt and investments

- Risk and hedging strategies

Treasury processes and procedures

Streamline treasury procedures to enhance cash flow management and financial asset oversight, ensuring optimal liquidity for efficient operations.

Use cases:

Establish data-driven treasury operations scope and governance

Develop dynamic, market-adaptable treasury policies

Implement continuous monitoring of treasury procedures

Enhance internal controls with real-time risk assessment

Update security requirements based on emerging threats

Cash

Leverage analytics to track cash flow, improve forecasting accuracy, and optimize cash on hand.

Use cases:

Generate cash flow analysis with predictive insights

Automate cash position reconciliation

Prepare cash equivalents reports with trend analysis

Optimize fund transfers with enhanced security

Develop ML-based cash flow forecasts

Manage banking relationships with data-driven insights

Analyze and optimize bank fees using historical data

In-house bank accounts

Efficiently merge cash flows from subsidiaries and business units to enhance visibility and simplify cash management using agentic automation.

Use cases:

Centralize in-house bank accounts and incoming payments

Streamline internal payments with automated reconciliation

Calculate interest and fees using real-time market data

Generate timely account statements

Manage inter-company loan transactions

Optimize central outgoing payments with intelligent scheduling

Debt and investments

Enhance strategic supervision of financial resources and implement advanced treasury procedures to maximize liquidity and improve performance.

Use cases:

Optimize liquidity with real-time cash analysis

Enhance exposure handling with automated risk

Streamline debt and investment processing

Automate forex transactions with live rates

Generate transaction reports

Execute interest rate transactions

Strengthen financial intermediary relations

Risk and hedging strategies

Implement advanced analytics to monitor rate changes, anticipate trends, and minimize risk with precision and speed.

Use cases:

Execute hedging transactions with real-time market data

Produce hedge account transactions and reports with automated analysis

Enhance interest rate risk management through predictive modeling

Tackle foreign exchange risk with adaptive strategies

Oversee exposure risk with real-time monitoring and alerts

Stop pushing paper and start driving real change

White paper

How AI-powered finance automation delivers transformative business value

Learn how AI can uncover inefficiencies and identify opportunities.