With volatility, inflation, and rate hikes so high... give banking automation a try.

In today's banks, the value of automation might be the only thing that isn't transitory.

The UiPath Business Automation Platform empowers your workforce with unprecedented resilience—helping organizations thrive in dynamic economic, regulatory, and social landscapes. The world's top financial services firms are bullish on banking RPA and automation. Why? It helps them outperform their peers by 3x.

Events

How can AI-powered automation change banking and insurance?

Learn from the success stories of top-tier banks and insurance firms, discover the newest best practices in intelligent document processing and process orchestration, and gain first-hand insights into cutting-edge automation technologies. Sharpen your competitive edge and boost operational efficiency at this must-attend financial services summit.

McKinsey

43%

of banking processes can be automated

Everest Group

50%

of surveyed enterprises have >$1 million cost savings from automation

McKinsey

~60%

of financial services firms have embedded AI+RPA in their operations

Full banking automation coverage

In a world of point solutions, the UiPath Business Automation Platform does it all

Increase revenue capture

Remove manual touch points and enable straight-through processing

Strengthen risk posture

Improve risk profiles and optimize existing controls

Raise NPS scores

Elevate customer engagement with better journeys and user experience

Lower operational costs

Streamline customer experience across different channels

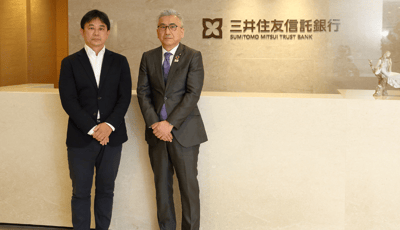

Case Study

Sumitomo Mitsui Trust Bank saves 400,000 hours with automation

With UiPath, SMTB built over 500 workflow automations to streamline operations across the enterprise. Learn how SMTB is bringing a new perspective and approach to operations with automation at the center.

Case Study

PRMG saves $6 for every $1 invested in automation

Learn how PRMG is shortening loan processing times, increasing the accuracy of data, and reducing manual touch points in their workflows

Case Study

Danske Bank deploys automations created by their 'citizen developers'

Learn how Danske bank is deploying 250 automation solutions across the bank, freeing employees for higher value-added work in the process

Top automation areas

Banking and financial services automation

Consumer banking

Efficient workflows appraise high. Capture that value with automation.

UiPath delivers a new standard in efficiency. By elevating customer journeys, accelerating lending timelines, and modernizing KYC, automation brings consumer banks into today's digital age. And shortly thereafter, helps them revolutionize their entire way of operating (and innovating!)

Lending

Inefficient lending cycles? We can lend a hand.

Automation helps shorten the lending cycle by digitizing documents, automating mundane tasks, and giving agents a digital sidekick.

Business Use Cases:

Origination

Loan processing

Underwriting

Funding

Administration and monitoring

Default management

Customer experience

Give customers the info they need, via the channel they prefer.

Discover smarter self-service customer journeys, and equip contact center agents with data that dramatically lowers average handling times.

Transform the customer lifecycle journey, reducing onboarding times, and lowering lifecycle management spend by 15-20%.

Business use cases:

Account maintenance

Data extraction

Customer support

Onboarding and account set-up

KYC and due diligence

Fees and chargebacks

Account closure

Cash withdrawal / deposit

Cards and payments

Slow down fraud, speed up dispute resolution.

Find value in overlooked disputes by automating the classification and management of chargebacks and dispute resolutions.

Business use cases:

Prospecting and application

Processing and approvals

Payments and settlement

Collections and servicing

Dispute and fraud management

Network management

Risk and compliance

Ensure compliance with an always-on auditing machine.

Pivot away from periodic controls and towards continuous testing. Automation frees auditors from tedious data extraction so they can focus on what they do best: analyzing results.

Business use cases:

KYC and client due diligence

Transaction monitoring

Screening and alerts management

Risk monitoring

Reporting internal / external

1 / 4

Commercial banking

We modernize the way commercial banks get down to business, so clients know they mean business.

UiPath delivers intelligent automation you can bank on. It connects disparate systems and makes sense of unstructured data, so you can offer exceptional service and personalize offerings at unprecedented scale.

Liquidity and treasury

Trade risky and tedious for streamlined and secured

Automation helps banks streamline treasury operations by increasing productivity for front office traders, enabling better risk management, and improving customer experience.

Business use cases:

Order management

Order processing

Fee management

Customer support

Commercial lending

Volatile interest rates and inefficiencies? We can lend a hand.

Automation helps shorten the lending cycle by digitizing documents, automating mundane tasks, and giving agents a digital sidekick.

Business use cases:

Origination

Loan processing

Underwriting

Funding

Administration and monitoring

Default management

Client management

Achieve frictionless onboarding with RPA + automation

Automation accelerates the lifecycle journey, reduces customer onboarding times, and lowers operational spend for lifecycle management by 15-20%.

Business use cases:

Onboarding/KYC

Account servicing

Account closure

Risk and compliance

Ensure compliance with an always-on auditing machine

Pivot away from periodic controls and towards continuous testing. Automation frees auditors from tedious data extraction so they can focus on what they do best: Analyzing results.

Business use cases:

Risk monitoring

Reporting internal / external

1 / 4

Capital markets

Outperform market uncertainty with workforce resiliency

Traders, advisors, and analysts rely on UiPath to supercharge their productivity and be the best at what they do. Address resource constraints by letting automation handle time-demanding operations, connect fragmented tech, and reduce friction across the trade lifecycle.

Front office

Trade risky and tedious for secure and efficient

With RPA and automation, faster trade processing – paired with higher bookings accuracy – allows analysts to devote more attention to clients and markets.

Business use cases:

Order management

Trade booking

Model maintenance

Portfolio rebalancing

Security lending

Counterparty relationship management

Client servicing

Time spent with clients beats time spent with paperwork

Accelerate time to process a request with greater straight-through-processing rates and more client coverage

Business use cases:

New accounts

Client onboarding

TCA reporting

Fee management

Connectivity

Trade allocations

Operations

Automation lets operations operate automatically

Introduce end to end straight-through-processing to otherwise disconnected teams, applications, and channels

Business use cases:

Clearing

Trade settlement

Collateral management

Corporate actions

Reconciliation

Reference data management

Risk and compliance

Ensure compliance with an always-on auditing machine

Pivot away from periodic controls and towards continuous testing. Automation frees auditors from tedious data extraction so they can focus on what they do best: Analyzing results.

Business use cases:

KYC and client due diligence

Transaction monitoring

Screening and alerts management

Risk monitoring

Reporting internal / external

1 / 4

Webinar

Next-level operations: Why financial services are banking on AI and automation

During this on-demand session from our AI Summit, you’ll learn: practical insights on leveraging AI to streamline processes and enhance operational efficiency; real examples of successful implementations from industry leaders like OMERS; strategies for using automation to drive profitability and adapt in a rapidly evolving financial landscape.

More in financial services automation

Don't miss these resources, events, and recaps.

White paper

Customer experience in banking

Download this e-book to learn how customer experience and contact center leaders in banking are using Al-powered automation.

White paper

Turn AI potential into AI results: 8 steps to success in banking

Download this white paper and discover how to create a roadmap to deliver value at scale across your bank.

Webinar